Connecticut Tax Rates By Town . To calculate the property tax, multiply the assessment of the property by the mill. A mill is equal to $1.00 of tax for each $1,000 of assessment. A home assessed at $200,000 in a town with a mill rate. each town has a mill rate, which is the amount of tax per $1,000 dollars of assessment. A mill rate is the rate that's used to calculate your property tax. which town has the highest property tax rate in connecticut? to calculate the property tax, multiply the assessment of the property by the mill rate and divide by 1,000. Hartford has the highest property taxes in connecticut with a mill. Click here for a map with more connecticut tax rate. Click here for a map with more ct tax rate.

from www.seaportre.com

A mill rate is the rate that's used to calculate your property tax. to calculate the property tax, multiply the assessment of the property by the mill rate and divide by 1,000. Click here for a map with more connecticut tax rate. Click here for a map with more ct tax rate. Hartford has the highest property taxes in connecticut with a mill. A mill is equal to $1.00 of tax for each $1,000 of assessment. each town has a mill rate, which is the amount of tax per $1,000 dollars of assessment. To calculate the property tax, multiply the assessment of the property by the mill. A home assessed at $200,000 in a town with a mill rate. which town has the highest property tax rate in connecticut?

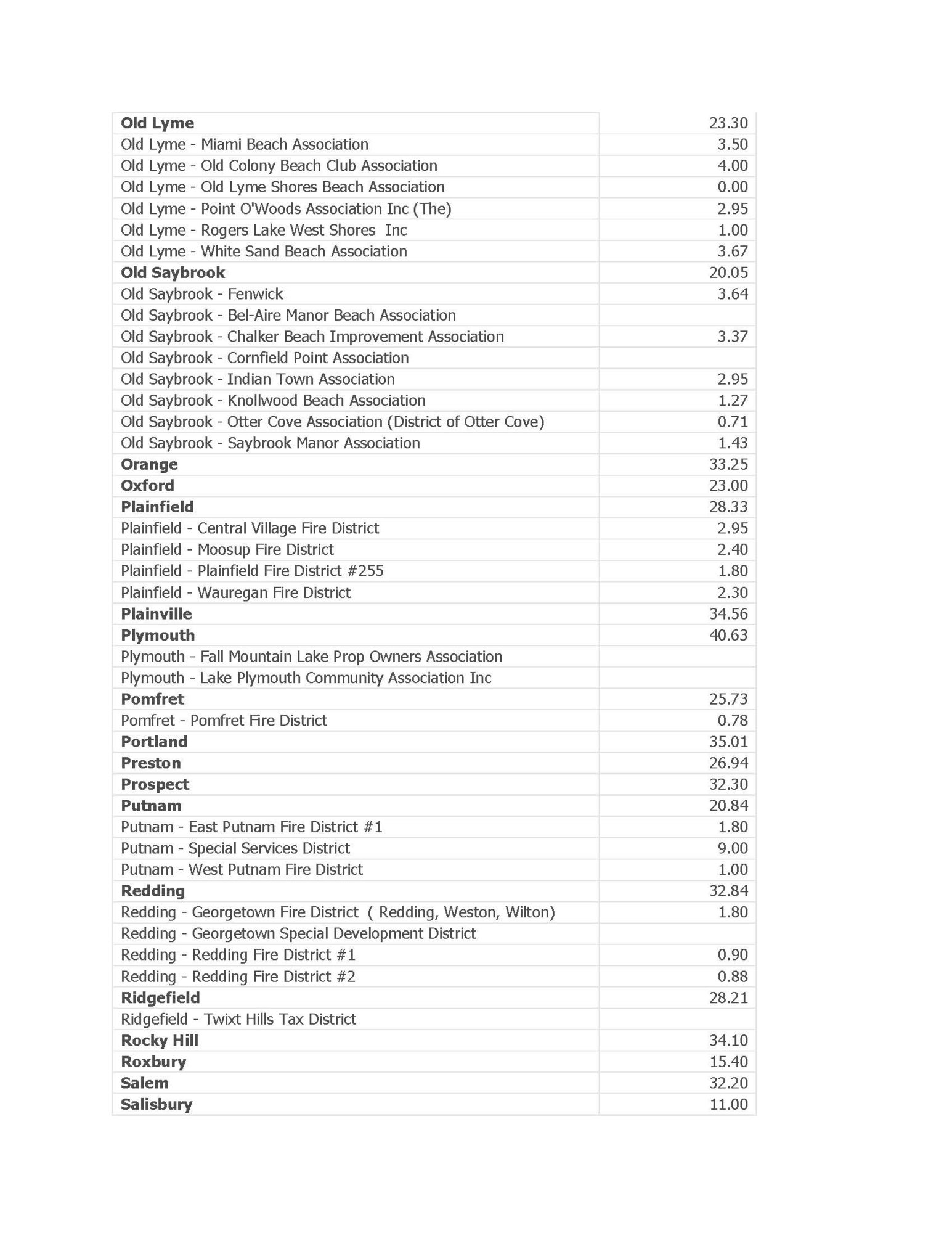

2022 Connecticut Real Estate Mill Rates by Town

Connecticut Tax Rates By Town each town has a mill rate, which is the amount of tax per $1,000 dollars of assessment. Click here for a map with more connecticut tax rate. Click here for a map with more ct tax rate. A home assessed at $200,000 in a town with a mill rate. A mill is equal to $1.00 of tax for each $1,000 of assessment. which town has the highest property tax rate in connecticut? To calculate the property tax, multiply the assessment of the property by the mill. A mill rate is the rate that's used to calculate your property tax. Hartford has the highest property taxes in connecticut with a mill. to calculate the property tax, multiply the assessment of the property by the mill rate and divide by 1,000. each town has a mill rate, which is the amount of tax per $1,000 dollars of assessment.

From catherinawnessi.pages.dev

Ct Tax Brackets 2024 Brier Corliss Connecticut Tax Rates By Town To calculate the property tax, multiply the assessment of the property by the mill. A mill rate is the rate that's used to calculate your property tax. which town has the highest property tax rate in connecticut? to calculate the property tax, multiply the assessment of the property by the mill rate and divide by 1,000. Click here. Connecticut Tax Rates By Town.

From www.pinterest.com

Connecticut Mill Property Tax Rates CT Town Property Taxes Falls Connecticut Tax Rates By Town To calculate the property tax, multiply the assessment of the property by the mill. to calculate the property tax, multiply the assessment of the property by the mill rate and divide by 1,000. A mill is equal to $1.00 of tax for each $1,000 of assessment. Click here for a map with more connecticut tax rate. A mill rate. Connecticut Tax Rates By Town.

From taxfoundation.org

Connecticut Tax Competitiveness Enhancing Tax Competitiveness in CT Connecticut Tax Rates By Town A mill is equal to $1.00 of tax for each $1,000 of assessment. which town has the highest property tax rate in connecticut? Click here for a map with more connecticut tax rate. each town has a mill rate, which is the amount of tax per $1,000 dollars of assessment. Click here for a map with more ct. Connecticut Tax Rates By Town.

From www.retirementliving.com

Connecticut Tax Rates 2024 Retirement Living Connecticut Tax Rates By Town Hartford has the highest property taxes in connecticut with a mill. To calculate the property tax, multiply the assessment of the property by the mill. which town has the highest property tax rate in connecticut? A mill rate is the rate that's used to calculate your property tax. Click here for a map with more ct tax rate. Click. Connecticut Tax Rates By Town.

From www.seaportre.com

2022 Connecticut Real Estate Mill Rates by Town Connecticut Tax Rates By Town To calculate the property tax, multiply the assessment of the property by the mill. A mill rate is the rate that's used to calculate your property tax. Click here for a map with more connecticut tax rate. which town has the highest property tax rate in connecticut? Hartford has the highest property taxes in connecticut with a mill. Web. Connecticut Tax Rates By Town.

From www.seaportre.com

2022 Connecticut Real Estate Mill Rates by Town Connecticut Tax Rates By Town A mill rate is the rate that's used to calculate your property tax. A mill is equal to $1.00 of tax for each $1,000 of assessment. To calculate the property tax, multiply the assessment of the property by the mill. A home assessed at $200,000 in a town with a mill rate. Click here for a map with more ct. Connecticut Tax Rates By Town.

From lonaqmarice.pages.dev

Ct Tax 2024 Terza Connecticut Tax Rates By Town each town has a mill rate, which is the amount of tax per $1,000 dollars of assessment. To calculate the property tax, multiply the assessment of the property by the mill. A mill rate is the rate that's used to calculate your property tax. Hartford has the highest property taxes in connecticut with a mill. A home assessed at. Connecticut Tax Rates By Town.

From www.thestreet.com

These States Have the Highest Property Tax Rates TheStreet Connecticut Tax Rates By Town A home assessed at $200,000 in a town with a mill rate. Click here for a map with more ct tax rate. each town has a mill rate, which is the amount of tax per $1,000 dollars of assessment. A mill is equal to $1.00 of tax for each $1,000 of assessment. Hartford has the highest property taxes in. Connecticut Tax Rates By Town.

From annabellewfayre.pages.dev

Connecticut State Tax Rate 2024 Lenee Appolonia Connecticut Tax Rates By Town Hartford has the highest property taxes in connecticut with a mill. Click here for a map with more connecticut tax rate. Click here for a map with more ct tax rate. to calculate the property tax, multiply the assessment of the property by the mill rate and divide by 1,000. To calculate the property tax, multiply the assessment of. Connecticut Tax Rates By Town.

From ctvoices.org

Connecticut Taxes Lower Than New York's for Everyone but the Poor CT Connecticut Tax Rates By Town Click here for a map with more connecticut tax rate. each town has a mill rate, which is the amount of tax per $1,000 dollars of assessment. A mill rate is the rate that's used to calculate your property tax. to calculate the property tax, multiply the assessment of the property by the mill rate and divide by. Connecticut Tax Rates By Town.

From ctmirror.org

Will Hartford's crisis force a CT property tax overhaul? Connecticut Tax Rates By Town Hartford has the highest property taxes in connecticut with a mill. A mill is equal to $1.00 of tax for each $1,000 of assessment. to calculate the property tax, multiply the assessment of the property by the mill rate and divide by 1,000. A home assessed at $200,000 in a town with a mill rate. Click here for a. Connecticut Tax Rates By Town.

From yankeeinstitute.org

Connecticut’s 2022 Taxes and Fees Yankee Institute Connecticut Tax Rates By Town Click here for a map with more connecticut tax rate. To calculate the property tax, multiply the assessment of the property by the mill. A mill rate is the rate that's used to calculate your property tax. Hartford has the highest property taxes in connecticut with a mill. A home assessed at $200,000 in a town with a mill rate.. Connecticut Tax Rates By Town.

From www.youtube.com

How Connecticut Taxes Retirees YouTube Connecticut Tax Rates By Town Click here for a map with more connecticut tax rate. A mill rate is the rate that's used to calculate your property tax. Click here for a map with more ct tax rate. Hartford has the highest property taxes in connecticut with a mill. A mill is equal to $1.00 of tax for each $1,000 of assessment. to calculate. Connecticut Tax Rates By Town.

From jermainewalvira.pages.dev

Ct 2024 Tax Rates Maxy Fenelia Connecticut Tax Rates By Town Hartford has the highest property taxes in connecticut with a mill. A mill rate is the rate that's used to calculate your property tax. Click here for a map with more connecticut tax rate. Click here for a map with more ct tax rate. to calculate the property tax, multiply the assessment of the property by the mill rate. Connecticut Tax Rates By Town.

From laptrinhx.com

Connecticut ranks 47th for business tax climate, according to Tax Connecticut Tax Rates By Town Hartford has the highest property taxes in connecticut with a mill. A mill rate is the rate that's used to calculate your property tax. Click here for a map with more ct tax rate. A home assessed at $200,000 in a town with a mill rate. To calculate the property tax, multiply the assessment of the property by the mill.. Connecticut Tax Rates By Town.

From patch.com

Connecticut Property Taxes In Every Town Who Pays The Most? Across Connecticut Tax Rates By Town to calculate the property tax, multiply the assessment of the property by the mill rate and divide by 1,000. which town has the highest property tax rate in connecticut? Hartford has the highest property taxes in connecticut with a mill. Click here for a map with more ct tax rate. A home assessed at $200,000 in a town. Connecticut Tax Rates By Town.

From danieljmitchell.wordpress.com

BluetoRed Migration, Part III The SlowMotion Suicide of HighTax Connecticut Tax Rates By Town to calculate the property tax, multiply the assessment of the property by the mill rate and divide by 1,000. Click here for a map with more connecticut tax rate. Click here for a map with more ct tax rate. which town has the highest property tax rate in connecticut? A mill rate is the rate that's used to. Connecticut Tax Rates By Town.

From www.mmta.com

UPDATE Connecticut Passes Onerous Weight Distance Tax Implementation Connecticut Tax Rates By Town to calculate the property tax, multiply the assessment of the property by the mill rate and divide by 1,000. Hartford has the highest property taxes in connecticut with a mill. Click here for a map with more ct tax rate. A mill is equal to $1.00 of tax for each $1,000 of assessment. To calculate the property tax, multiply. Connecticut Tax Rates By Town.