Differential Pricing In Ipo . what is differential pricing? Differential pricing is achieved by developing different prices and offerings to cater to. when a specific category is offered shares at a price different than the other categories, the act is called as differential pricing. initial public offerings (ipos) regulations & process. two identical companies may have very different ipo valuations simply because of the timing of the ipo and market demand. pricing of an issue where one category is offered shares at a price different from the other category is called differential. differential pricing, also known as dual pricing, is a pricing strategy used in finance where different categories of investors are.

from www.collidu.com

differential pricing, also known as dual pricing, is a pricing strategy used in finance where different categories of investors are. Differential pricing is achieved by developing different prices and offerings to cater to. pricing of an issue where one category is offered shares at a price different from the other category is called differential. what is differential pricing? initial public offerings (ipos) regulations & process. when a specific category is offered shares at a price different than the other categories, the act is called as differential pricing. two identical companies may have very different ipo valuations simply because of the timing of the ipo and market demand.

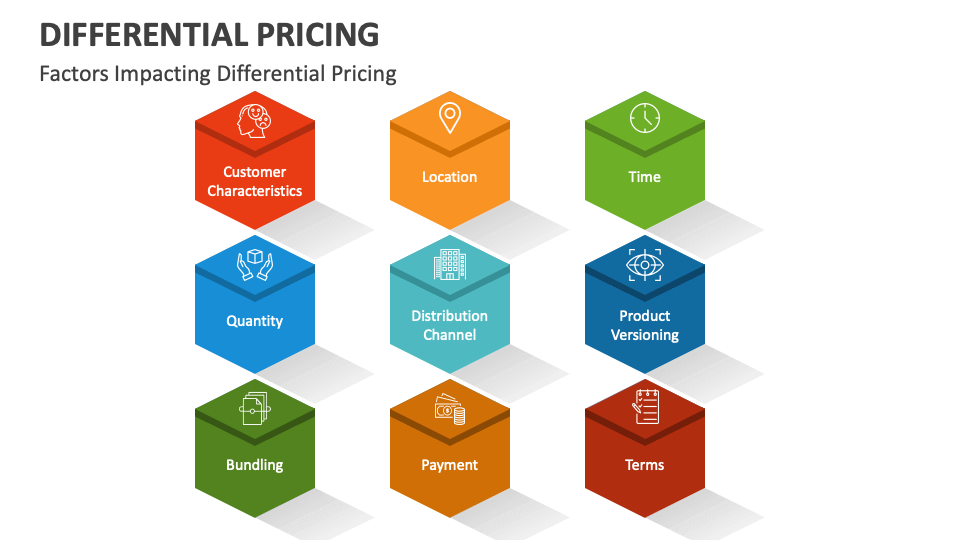

Differential Pricing PowerPoint Presentation Slides PPT Template

Differential Pricing In Ipo when a specific category is offered shares at a price different than the other categories, the act is called as differential pricing. pricing of an issue where one category is offered shares at a price different from the other category is called differential. differential pricing, also known as dual pricing, is a pricing strategy used in finance where different categories of investors are. Differential pricing is achieved by developing different prices and offerings to cater to. when a specific category is offered shares at a price different than the other categories, the act is called as differential pricing. two identical companies may have very different ipo valuations simply because of the timing of the ipo and market demand. what is differential pricing? initial public offerings (ipos) regulations & process.

From www.slideserve.com

PPT CHAPTER 5 The eMarketing Mix PowerPoint Presentation, free Differential Pricing In Ipo what is differential pricing? pricing of an issue where one category is offered shares at a price different from the other category is called differential. when a specific category is offered shares at a price different than the other categories, the act is called as differential pricing. differential pricing, also known as dual pricing, is a. Differential Pricing In Ipo.

From konigle.com

What is differential pricing Differential Pricing In Ipo pricing of an issue where one category is offered shares at a price different from the other category is called differential. two identical companies may have very different ipo valuations simply because of the timing of the ipo and market demand. what is differential pricing? Differential pricing is achieved by developing different prices and offerings to cater. Differential Pricing In Ipo.

From www.slideteam.net

Differential Pricing Strategies To Gain Competitive Advantage Price Differential Pricing In Ipo two identical companies may have very different ipo valuations simply because of the timing of the ipo and market demand. Differential pricing is achieved by developing different prices and offerings to cater to. differential pricing, also known as dual pricing, is a pricing strategy used in finance where different categories of investors are. initial public offerings (ipos). Differential Pricing In Ipo.

From www.collidu.com

Differential Pricing PowerPoint Presentation Slides PPT Template Differential Pricing In Ipo Differential pricing is achieved by developing different prices and offerings to cater to. pricing of an issue where one category is offered shares at a price different from the other category is called differential. two identical companies may have very different ipo valuations simply because of the timing of the ipo and market demand. what is differential. Differential Pricing In Ipo.

From www.ou.edu

Differential Pricing Strategy Differential Pricing In Ipo two identical companies may have very different ipo valuations simply because of the timing of the ipo and market demand. pricing of an issue where one category is offered shares at a price different from the other category is called differential. Differential pricing is achieved by developing different prices and offerings to cater to. what is differential. Differential Pricing In Ipo.

From dxojsdmea.blob.core.windows.net

Differential Pricing Mechanism at Danielle Patterson blog Differential Pricing In Ipo differential pricing, also known as dual pricing, is a pricing strategy used in finance where different categories of investors are. when a specific category is offered shares at a price different than the other categories, the act is called as differential pricing. what is differential pricing? pricing of an issue where one category is offered shares. Differential Pricing In Ipo.

From www.slideserve.com

PPT Pricing Strategies PowerPoint Presentation, free download ID Differential Pricing In Ipo differential pricing, also known as dual pricing, is a pricing strategy used in finance where different categories of investors are. when a specific category is offered shares at a price different than the other categories, the act is called as differential pricing. Differential pricing is achieved by developing different prices and offerings to cater to. two identical. Differential Pricing In Ipo.

From www.slideserve.com

PPT Chapter 4.2 Differential Pricing PowerPoint Presentation, free Differential Pricing In Ipo when a specific category is offered shares at a price different than the other categories, the act is called as differential pricing. initial public offerings (ipos) regulations & process. pricing of an issue where one category is offered shares at a price different from the other category is called differential. two identical companies may have very. Differential Pricing In Ipo.

From www.collidu.com

Differential Pricing PowerPoint Presentation Slides PPT Template Differential Pricing In Ipo initial public offerings (ipos) regulations & process. two identical companies may have very different ipo valuations simply because of the timing of the ipo and market demand. pricing of an issue where one category is offered shares at a price different from the other category is called differential. what is differential pricing? Differential pricing is achieved. Differential Pricing In Ipo.

From www.thekeepitsimple.com

Differential Pricing Strategy Meaning Examples Pros & Cons Differential Pricing In Ipo when a specific category is offered shares at a price different than the other categories, the act is called as differential pricing. initial public offerings (ipos) regulations & process. pricing of an issue where one category is offered shares at a price different from the other category is called differential. differential pricing, also known as dual. Differential Pricing In Ipo.

From scripbox.com

Types of IPOs Difference Between Fixed Price and Book Building Issue Differential Pricing In Ipo initial public offerings (ipos) regulations & process. Differential pricing is achieved by developing different prices and offerings to cater to. pricing of an issue where one category is offered shares at a price different from the other category is called differential. what is differential pricing? differential pricing, also known as dual pricing, is a pricing strategy. Differential Pricing In Ipo.

From www.vcita.com

Price points matter Implementing differential pricing strategy vcita Differential Pricing In Ipo what is differential pricing? Differential pricing is achieved by developing different prices and offerings to cater to. differential pricing, also known as dual pricing, is a pricing strategy used in finance where different categories of investors are. initial public offerings (ipos) regulations & process. two identical companies may have very different ipo valuations simply because of. Differential Pricing In Ipo.

From www.simon-kucher.com

Differential Pricing What Is It and How to Use This Pricing Strategy Differential Pricing In Ipo what is differential pricing? pricing of an issue where one category is offered shares at a price different from the other category is called differential. differential pricing, also known as dual pricing, is a pricing strategy used in finance where different categories of investors are. Differential pricing is achieved by developing different prices and offerings to cater. Differential Pricing In Ipo.

From www.sketchbubble.com

Differential Pricing PowerPoint and Google Slides Template PPT Slides Differential Pricing In Ipo when a specific category is offered shares at a price different than the other categories, the act is called as differential pricing. two identical companies may have very different ipo valuations simply because of the timing of the ipo and market demand. what is differential pricing? initial public offerings (ipos) regulations & process. Differential pricing is. Differential Pricing In Ipo.

From theinvestorsbook.com

What is Differential Pricing? definition, grounds, advantages and Differential Pricing In Ipo initial public offerings (ipos) regulations & process. what is differential pricing? differential pricing, also known as dual pricing, is a pricing strategy used in finance where different categories of investors are. when a specific category is offered shares at a price different than the other categories, the act is called as differential pricing. pricing of. Differential Pricing In Ipo.

From www.slideserve.com

PPT IPOs Process and Pricing PowerPoint Presentation, free download Differential Pricing In Ipo two identical companies may have very different ipo valuations simply because of the timing of the ipo and market demand. initial public offerings (ipos) regulations & process. Differential pricing is achieved by developing different prices and offerings to cater to. differential pricing, also known as dual pricing, is a pricing strategy used in finance where different categories. Differential Pricing In Ipo.

From www.aar.org

Differential Pricing Figure 1 Association of American Railroads Differential Pricing In Ipo two identical companies may have very different ipo valuations simply because of the timing of the ipo and market demand. pricing of an issue where one category is offered shares at a price different from the other category is called differential. initial public offerings (ipos) regulations & process. Differential pricing is achieved by developing different prices and. Differential Pricing In Ipo.

From slideplayer.com

Unit 4 Strategies for Pricing Information Goods ppt download Differential Pricing In Ipo initial public offerings (ipos) regulations & process. Differential pricing is achieved by developing different prices and offerings to cater to. differential pricing, also known as dual pricing, is a pricing strategy used in finance where different categories of investors are. pricing of an issue where one category is offered shares at a price different from the other. Differential Pricing In Ipo.